The usual collection of things which caught my attention in the last week (or so).

A late one because Substack went down on Friday afternoon (dog ate my homework 😉) and I spent the weekend on the beach.

Product Delivery

Related (perhaps very tenuously) to getting the right things done.

VanMoof files for bankruptcy protection, it’s impossible not to be impressed by the design and engineering of the VanMoof bikes (this turns quickly to envy when you look up the 2-4k price tag). Unfortunately their business model doesn’t appear to have worked, the management team seems to have jumped ship and the company has filed for bankruptcy protection. There’s an obvious point that having a great product doesn’t automatically mean having a great business. The more interesting angle though is that the bikes were/are dependent on VanMoof apps and servers for some functionality. When the company goes bust those things disappear. In some sense when you bought a bike you were also purchasing a perpetual license and becoming an unsecured creditor. Also reminded me of John Deere and how their control of the tractor OS basically meant farmers were purchasing a conditional license to use a tractor rather than purchasing a tractor (though this has at least partially reversed).

The (Unmet) Potential of Open Banking, this report commissioned by NatWest outlines the current state of open banking in the UK - while not as frank as Anne Boden’s broadside, the conclusion is essentially the same, open banking is a failure. Penetration sits around ~10% of adult population and 0.3% of payments by volume. Quite simply in retail payments it doesn’t offer anywhere near what Visa/Mastercard do, on the data side the market of weird obsessives (guilty) who want dashboards of their spending just isn’t that large. Open banking is a neat product (or a feature) but not a business.

How Roku Grows: The Platform For Streaming Platforms, living in the UK where in 2021 Roku had only an ~8% share (trailing behind Samsung, Chromecast, Fire TB, LG TV and even Android TV) it’s easy to forget it exists at all. Let alone that they have a ~50% share in the US. This position (especially as the default on many TVs) allows them to extract meaningful rents from streaming services - exactly as Apple does on iPhone. I think the most interesting threat for them isn’t the TV manufacturers who have long ago been the commoditised complement of broadcasters/streamers. Instead their threat is Google and Apple (and to some extent Amazon). The ‘mobile phone as remote control’ is a powerful user experience and enables second-screen experiences (Amazon executes this very well) - but most of all it leverages the existing position of mobile phones as a universal default.

Was it Worth it for Facebook to Become Meta? ($), with the AI hype train well underway it’s easy to forget (unless you happened to be long Meta) that last year they lost ~70% of their market-cap on the back of the combination of Apple’s privacy changes, rising interest rates and their massive bet on the metaverse. Byrne Hobart does some back-of-napkin math on this bet which basically boils down to “how much money would it have been optimal for Facebook to spend in order to have a shot at owning the next iOS or Android?” On this basis you can easily get to values like $400b (20x multiple on the $20b/pa that Google pays to be the default search provider on iOS) so even a (lowball?) 10% chance of success could be worth spending $40b on. For comparison their current burn-rate on it is probably something like $10b/yr. Meta is an unusual company in their willingness to make these kind of bets but that stems from being unusually perceptive about their market position and unusually aggressive in execution - both of which are positive attributes.

Disclosure: long Meta

Status Over Money, Money Over Status ($), next time you are interviewing and negotiating for a new job have a think about the trade-off between status (industry, company, title, etc) and compensation (money, equity, etc). Else-equal you will often see less desirable (e.g. lower status) industries/companies giving more exalted titles and/or more money. Think gambling, oil/gas, tobacco, etc. Henderson comes across as somewhat sceptical about the value of trading less pay to get a better title. As a counter-point though;

The up-title + down-pay trade at company A can open the door to the up-title + up-pay position at company B

More importantly trading down in title at company A can then re-baseline you to the lower-title + lower-pay at all other companies.

Building a winning AI neobank (2022), obviously this is a sales-pitch for McKinsey, filled with consultant-speak and largely rehashing old ideas (speed, open banking, customer engagement, etc). But there is a kernel of a genuine insight in the mix - conversational banking. Thirty years ago the model of banking was that customers would have a conversation with a teller, branch manager, etc who then in turn filled in a form (paper or digital) which moved some money around. Digitisation of banking has largely meant jettisoning those conversations and having customers directly fill in the form themselves with the main point of differentiation being how painful the form is to use. Chatbots may be a way to reverse this and return to a conversational interaction. The big question is whether customers will want that or not.

What can we learn from Village's Zitcha/retail media deal?, this is an interesting deal to basically expand and digitise the market for in-store advertising. Where traditionally this has been relatively limited (companies tend to advertise only themselves and things they sell) and relatively manual (CPG companies paying for shelf-space in stores) in the future we should expect to see much more advertising in stores (and on websites). The real unlock will be companies who can find a way to leverage their proprietary data to deliver relevant (and hence high value) ads.

How to pass any first-round interview, a lot of generally good advice - one piece in particular to highlight is the power of mirroring. Essentially identify key words and phrases which the company uses to describe themselves and the role - then use these to describe yourself and your experiences. If you are interviewing at/with senior levels then you can take this one step further - search for any interviews, podcasts, etc with your interviewer and mine these for insights into how they think and what they value.

Meet Citadel X($) via The Diff ($), interesting peek at some of the work behind the scenes at a hedge fund. Citadel has a dedicated ~20 person rapid response engineering team to build/improve/repair internal tooling. Most companies tend to under-value (and hence under-invest) in internal tooling because they see it as a cost-centre to be minimised. The nature of work in a hedge fund makes it more obvious that speed/reliability/accuracy/usability/etc of internal tools can directly deliver meaningful value. The article also talks about being able to turn around changes/new apps in minutes (!) and same-day (!) - I think this is definitely some strategic exaggeration, however it does hint at two important things they likely have done:

Invested heavily in an underlying core platform which they are building on top of in some kind of low-code/no-code way

Invested heavily in developer tooling and automated tests to allow them to deploy to production very very quickly (or removed the need to deploy in this way by building it within their platform).

Off-Topic

Not even tangentially related to product delivery, but still interesting (to me).

Why Match School And Student Rank?, an interesting take on what elite universities are selling. To the meritorious they sell the opportunity to network with both the meritorious and the wealthy. To the wealthy they sell the opportunity to appear meritorious. Effectively a classic laundering operation where you mix dirty money with clean money so that all the money looks clean (think Walter White’s investment in a car wash).

Solar Energy Solves Global Warming, another reminder that energy abundance is key. If electricity is cheap enough (solar or otherwise) then we can use it to power all kinds of (not massively efficient) processes - like desalination or carbon capture. Thinking like this is an important antidote to the hairshirts1 typical of the environmental movement which focuses on misanthrope goals like degrowth. The most intriguing idea is that we may get so good at carbon-capture that we need to price it so that we don’t end up with too little carbon in the atmosphere. Also interesting aside the current high levels of carbon in the atmosphere mean plants are growing 20-40% faster.

51 Things (and counting) Blamed on Capitalism, an entertaining list of things blamed on capitalism (late stage or otherwise).

Second Street Housing: Living next to, but not on top of main street via Noahpinion, there are two things which make this worth mentioning; (1) the importance of urbanists/YIMBYs selling their ideas visually and (2) the actual idea of second-street development. On (2) I think it’s an interesting idea and I’m certainly not opposed to it but I think the case against main street development is quite weak. There’s no reason to think that up-zoning main street needs to result in a street of garage doors and busy traffic - that’s entirely down to urban design and zoning considerations. Instead;

Main streets can be turned into shared zones with extensive street furniture, planting, etc to make them pedestrian/cycle friendly.

Garages, waste collection and other services can be placed on second-street which preserves the appeal of main street.

Mainstreet ground can be zoned for restaurants, cafes, pubs, barbers, gyms and any number of other businesses.

The secret to why Wimbledon is so green (Twitter thread) via International Intrigue.

What I got wrong about Covid ($), if you want to improve how often you are right (and you should!) then it’s critical to reflect on when/why you were wrong so you can recalibrate. Yglesias identified his misses as being too alarmed at the beginning, initially predicting political inaction and later being overly impressed by suppression (exclusion) in Asia. For my part:

I was dangerously ahead of the curve at the beginning - my attitude was to let it rip. But I formed that view before there was good evidence that this wouldn’t be bodies in the streets. That I was later proved more or less correct doesn’t detract from my overconfidence on no/limited information.

I didn’t predict the political response because I incorrectly thought that more people would share my view and wouldn’t want restrictions. People were much more scared than I expected and the demanded action. This also went on for much much longer than I expected.

Resources

Nothing new this week.

Something Fun

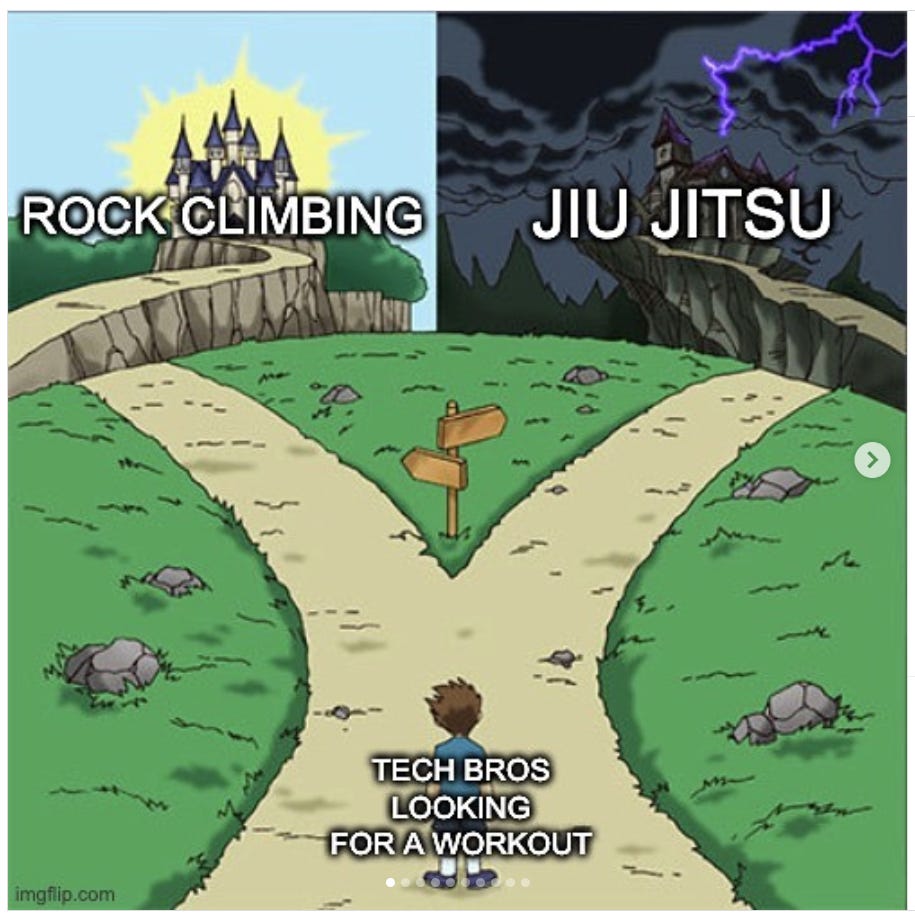

All via Slut4Banking