The usual collection of things which caught my attention in the last week (or so).

Product Delivery

Related (perhaps very tenuously) to getting the right things done.

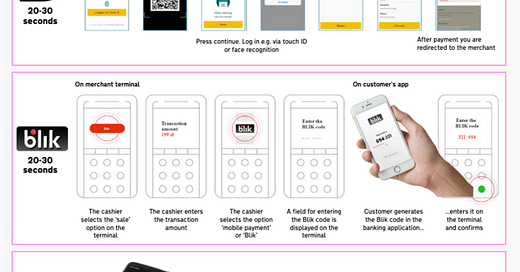

Open Banking doesn’t work for payments (in Europe), a reminder of a theme I’ve written about a few times - payments need to do two things (1) be very easy and (2) protect the consumer. Open banking systems do neither.

The Art of Early-Stage Investing, VC is a challenging game - you can be successful if something like 5% of your bets pay off - but that means that 100% of your bets need to be plausibly able to pay off like that. Some rules of thumb from the piece:

A great product will create a market so estimating TAM can be misleading - as a counter-point this is really an argument for doing a better job of estimating TAM and not just looking at incumbents.

Market timing matters - in particular I think this means the technology needs to be there, which is also why companies which are trying to invent the technology tend to be the highest risk.

‘Platforms’ are great businesses - personally I think this is overplayed. Most vertical-SaaS plays for example could be a platform (co-working booking software with a social network) but often it doesn’t make sense and is a distraction from building a conventional business. Also if it does work then you are stuck as a content moderator which is impossible (Meta is probably the best at this but is still constantly generating bad PR).

Founder vision - this is about a combination of strategic vision and relentless execution (canonically I think of Zuckerberg). Of course these are broadly applicable/valuable - for a possible unicorn you also need risk appetite far beyond what might be desirable in an established corporate.

Jensen Huang profile (New Yorker), an interesting profile on Huang. As an executive he combines an unusual degree of strategic foresight and an unusually high risk appetite to bet the company on it multiple times over. As Nvidia promotes AI technology I’m struck by the story of Samuel Brannan who promoted the California gold rush while buying gold pans for 20c and selling them to prospectors at $15 a ~98% markup, enough to make even Nvidia’s ~74% margin look modest.

Nvidia's China Problems, on the earnings front Nvidia had another solid quarter but two things trouble me:

They are playing whack-a-mole with US export controls, while the logic in favour is obvious (cash) I think the risk is underappreciated. The US could switch to imposing broader/vaguer restrictions which would impact more of the business and it's creating general bad blood which ups the chances of competitors being given literal billions to (try to) build fabs in the US.

It looks a lot like a FOMO driven overbuild which could leave Nvidia exposed to a sudden collapse in demand.

As an aside people seem to be making a lot out of the growth in their Singapore sales as a backdoor to China - my gut says this is more likely the major cloud providers ramping up their capacity in SG because it’s a major cloud hub in the region.

Robinhood on British Soil, the retail brokerage market in the UK is attractive because (1) it remains dominated by stodgy/expensive legacy players and (2) the potential for market expansion. Robinhood is hardly the first to notice. Freetrade and Trading212 have both built great products and built some market share - but neither of them have been able to transform the market. Robinhood will start with a much stronger brand (albeit with baggage) but a weaker product. My guess is that they use their much deeper pockets to fund an aggressive marketing campaign focused on growing the market rather than trying to cannibalise existing player - the catch will be whether they can solve the business model or will just be spending a lot on unprofitable growth.

Writing a product strategy doc, it’s almost year-end so you should already have a product strategy set for next year - but if you don’t then this is a decent starting point

Seek executive alignment - the guide recommends interviewing but in a big corporate you should be using corporate strategy and in a small start-up you should be in these discussions daily.

Seek horizontal alignment - everyone is developing their strategies, work together.

Get feedback - don’t assume people will read it by themselves, actively solicit feedback.

How Shopify’s Developer Experience Survey Works, the real takeaway from this is mindset - if you care about developer experience then you need to treat developers like customers and your tooling like products. Measure experience, make changes and measure results. Too often I see 'centres of excellence' who think of developers as unruly convicts to be put to work under strict supervision. Thankfully these groups are most often ignored so they're only wasting their own time not crippling the organisation.

Airlines Are Just Banks Now, this is one of those periodic pieces where people ‘discover’ that airlines make more money on their frequent flyer programmes than by actually flying. To break down the model for the uninitiated:

Whenever you make a card payment there is a fee which is paid by the merchant - and therefore baked into their cost and pricing.

This fee is divided up between the different players the merchant’s bank, the card scheme and the customer’s card issuer (bank/credit card company)

The biggest slice of this is typically the customer’s card issuer - because they take the biggest risk by providing credit to the consumer and guaranteeing payment to the merchant (Amex double’s up by being the card scheme and card issuer).

This fee rolls into revenue for the card issuer and they tend to be pretty good at underwriting risk so (usually) they aren’t making a lot of bad loans.

Banking is a competitive market though so they find ways to compete - sometimes this means direct cash back (Chase in the UK) but customers have a very strong (revealed) preference for airline points. It’s more fun to dream of an exotic holiday than to save 1% on a loaf of bread.

Banks don’t (usually) own airlines so they have to purchase the points from airlines.

Airlines set the redemption value of points and they tend to devalue them, make it hard to redeem, etc.

So airlines generate significant profit on their points business - and it supports their primary business (flying) by driving loyalty (especially from business travellers).

As in the article the prima facie objection to this is a regressive model where poor people are paying an extra X% for everything but the points are usually spent by rich people. This is really a broader objection to capitalism though. Basically anyone can get a card with some kind of benefits so no one is getting stiffed on the interchange. Obviously people who spend more are getting more benefit but it’s not at someone else’s expense. Inevitably this is really about people who want to re-regulate the airline industry despite deregulation delivering massive cost savings.

I’m reminded of this line from The Diff: “There's a kind of funny class marker involved in adults being secondhand-nostalgic for the days of better service and regulated fares. It's one of those ‘tell me your family was quite well-off by the 1970s without telling me’ things.”

How to Treat Schizophrenia, an inside look at the journey to take a drug through trials to commercialisation. As anyone who has spent anytime looking at biotech/pharma the trial process is maddeningly long, confusing and expensive.

Just host a dinner party already, this one is on the precipice of on/off-topic. Basically just host a dinner party. Broadening your network, making friends and deepening friendships is good. Having a diverse and wide ranging network gives you access to insights and opportunities you wouldn’t otherwise have. A friend-of-a-friend who is recruiting? Some not-quite inside information to trade on? An insight into an industry/company/country you you’re interested in? A soft-reference check on a candidate? Some travel ideas? Life advice? A romantic partner? Worst case a dinner party is an opportunity for good food and interesting discussion.

Off-Topic

Not even tangentially related to product delivery, but still interesting (to me).

This Gen Z Investigative Reporter Is Rocking Conservative Media, interesting profile of a reporter and touches on two key broader themes - which apply to both conservative and progressive media:

The internet provides an endless supply of opinion (myself included) but not a lot of reporting.

Journalism doesn’t pay very well which means a lot of people self-select out to other fields and the ones who are left are much more likely to be passionately ideological because why else would they persist.

Both of course are because no one has really found a business model which works for news media on the internet - well except for rage-clicks but even that is struggling.

The Big Fail (MR), great summary of a new book on the pandemic and how the key non-pharmaceutical interventions (lockdowns, distancing, masking, etc) were not supported by the science and were ultimately pointless. As an aside one of the areas I disagree most with Dominic Cummings is his insistence that the UK should have locked down sooner and harder.

The Effective Altruism Shell Game and Why the EA coup failed, the insights of EA are really the insights of utilitarianism reheated for a modern audience. There's nothing inherently wrong with that, utilitarianism has lots of insights to offer - but it's also not really a new idea. To look at the OpenAI coup attempt we need to unpack EA's turn towards 'long-termism'. Intellectually it's pretty straightforward if you care about utility maximisation then you should care not just about present-people but also future-people (it's no accident that EA took a turn to long-termism when we were in a zero/low-rate world - so the discount rate applied to future people was very low). So in a framework where the utility of trillions of future people dominate the calculus over billions of present people it makes sense to focus on existential risks to humanity (things which might wipe out those trillions before they even exist) instead of the humdrum issues impacting people today. The most prominent of the X-risks are nuclear war, meteorites and AI. Nuclear war is of course well trodden ground - albeit with no real solutions (unless you count MAD). Meteorites are also pretty well trodden ground but do actually have some good (albeit expensive) solutions - like colonising Mars. So EA thinkers have tended to focus on AI (singularity) as the less explored area. The problem is that it quickly becomes an intellectual dead-end where you can dream up horror scenarios but because the technology isn't actually real you can't solve the problems (but can have a fun time arguing about how any proposed solution wouldn't solve it). What it ends up boiling down to is insane ideas like banning AI development and bombing other countries which persist (because nuclear war with China has higher expected value than an AI apocalypse). I'm glad to see these ideas finally face a reckoning - and fail.

For his part Scott Alexander has two good response pieces (here and here), ultimately as an EA-adjacent person I think there is a lot of good stuff in the ideas (utilitarianism) and in the actions (mosquito nets, kidney donations, etc) but way too much baggage to identify as one.

Gallagher pulls back ‘naïve’ $344m GovERP project, ERP systems are effectively the accounting software which runs big businesses. All of the contracts, staffing, etc will end up in there and they are critical for a business to function. They are also incredibly expensive - and I’ve always thought this reflects their criticality far more than their complexity (a SQL database) or usability (horrendous). In Australia each government agency has their own and they customise it for their own workflows, staffing arrangements, etc. The big brains at Department of Finance look at this and think that instead of ~100 agencies separately purchasing the same software mostly from the same vendor (SAP) that they could get a better deal by setting up one master ERP to run them all and use this bargaining power to get a better deal. The reality is that you can’t. The ~100 agencies can’t and won’t align their workflows and staffing so now you need to configure all of it in one system - which exponentially increases complexity. And by making it bigger you increase the vendor lock in. Glad to see this killed off - unfortunately it’s already wasted minimum tens of millions.

Disclosure: I worked on this when it was in it’s infancy (under a Labor government) almost a decade ago - government moves quickly…

People are realizing that the Arsenal of Democracy is gone ($), again Smith is pushing the defence industrial base argument (we need wartime production capacity to deter/fight a great power war). But again this is long on problems and short on solutions. The solutions (such as they are) are:

Quasi-nationalisation - not a great track record

Spending a lot more money to build up stockpiles - but how much is enough? And to maintain the capacity you need to be continuously producing at a high rate (how high?) not at a low rate to sustain a large stockpile

Spending less on operations - to state the obvious the supposed benefits (global trade, etc) require operations and military capability can't just exist latent in boot camps you need to be constantly practising to be good at it

Improving procurement - this is really the only sensible point because if we could improve that then we could afford a much greater capability for less than we spend now. In my view the starting points for this are (1) don't treat the military industrial complex as a jobs programme (something Smith can be guilty of) and (2) stop chasing leading edge perfect systems and focus on commoditisation and competition. The parallels here for other government spending are obvious because we see the same pattern in things like public transit.

Obama mostly got things right ($), a defence of neoliberal centrism.

Resources

Product Mock Bot - requires ChatGPT Plus, an interview prep chatbot built on a database of Amazon/Meta/Google/etc interview questions.

FailoryGPT - requires ChatGPT Plus, a chatbot which tells you why your startup idea will fail, built on over 250 stories of failure.

Something Fun

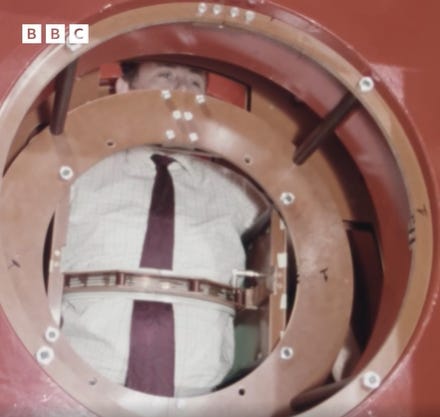

Short video of the first MRI machine (click through for video).

Instagram (story)